It is no secret that a majority of African economies are driven by wholesale and retail suppliers of goods and services. This is a segment characterized by buyers and sellers of finished goods or services and it is growing every day courtesy of the millions of unemployed youth in Africa. According to the African Development Bank, out of the nearly 420 million youth aged 15 to 35, only one out of six are in wage employment. The five out of six who are not in wage employment will likely end up in entrepreneurship. The first stop for most of these young entrepreneurs is trade ventures which do not require intensive capital investments. In line with this growth, we have seen the introduction of government initiatives such as “Access to Government Procurement Opportunities (AGPO)” which seeks to provide trade opportunities to the growing young African population.

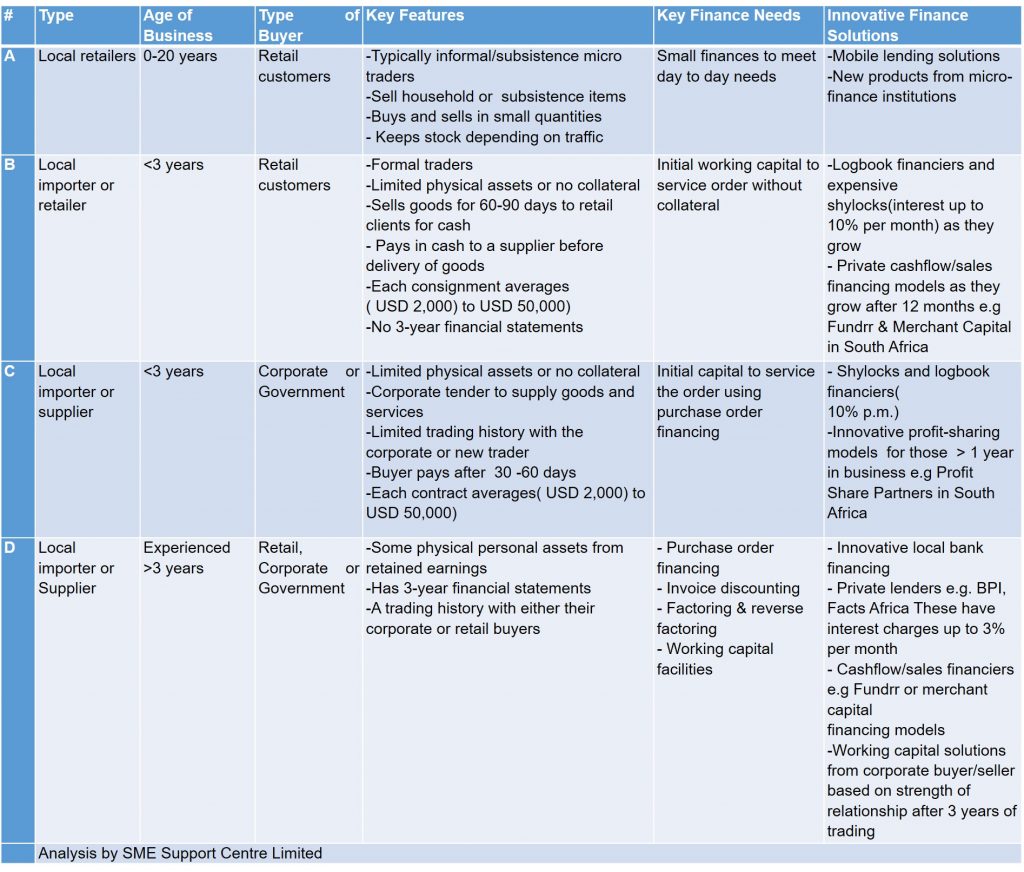

In recent years, we have also seen a flurry of financing solutions from private lenders geared towards addressing the urgent and immediate working capital needs of the African traders which can be summarized into three main components namely inventory, payables, and receivables. The key question remains which financing solutions are addressing the actual working capital needs of the African trader and which ones will be a hit for this growing segment? To answer this question, our team at the SME Support Centre, has analyzed the various African trader profiles, their key features, key financing needs, and the corresponding finance solutions that have been developed to support the working capital needs of the African MSME trader.

From the analysis, I am particularly drawn to segment B&C which is characterized by traders, less than three (3) years old with limited collateral who are either importers or local traders who supply finished goods or services to their retail or corporate customers. The main recourse for this trader, who has no collateral and cannot access local bank financing has been expensive shylocks and logbook financiers who charge an interest rate of at least 10% per month which is not sustainable depending on the trade margins for their good and services. This is a segment where a great opportunity lies yet a very risky segment. This segment includes a growing young and adult population that is going into entrepreneurship in Africa. In our opinion, private lending companies that will be able to offer more affordable financing for this segment to replace the shylocks and logbook financiers will be a great hit in Africa.

In this growing segment, we are starting to see the emergence of private lenders who finance based on cash flows, sales, or various profit share models targeting traders with a trading history of at least 12 months. For formal retail traders in segment B for example, these emerging models include South African based companies such as Fundrr https://www.fundrr.co.za/ and merchant capital https://www.merchantcapital.co.za/. Merchant capital, for example, has recently received an award “as the best “small business funding solution” in South Africa in 2020 .The company offers cash advances through a unique “ pay as you trade” system for retail traders with average sales of at least USD 1,800 per month. A key feature is a quick turn around and application time which meets the typical “urgent’’ requirements of many MSME traders in Africa. There are currently very few private players with similar models targeting formal retail traders in segment B in Africa and thus presents a very good opportunity for other private lenders to follow suit. Merchant capital for example has over the past 7 years served more than 7,000 retail businesses to the tune of more than USD 90 million.

Another prevalent working capital need for the African trader is purchase order financing especially for a trader in segment C who has an order to supply to a corporate customer but cannot access the capital needed to deliver, either because they do not qualify or because they do not have the necessary track record, financial history or paperwork. South African based https://profitsharepartners.com/ has developed a great disruption in this area. They provide purchase order equity partnership for MSMEs that have valid contracts or purchase with reputable companies. Basically what this means is that instead of providing capital as a form of a loan, they share in the profit with the MSME from their purchase order contracts. This is a much welcome relief to MSMEs who need to service their purchase orders at an affordable cost away from shylocks and also without the asset-based collateral requirements from the commercial banks.

In a nutshell, we believe that financing solutions that will be a hit in Africa will be those that will serve the growing needs and trade demands of MSMEs in segment B&C above. Crowdfunding platforms focused on working capital investments in this segment will also be a hit. The proposed solutions will have to rely on technology-based credit assessment models, offer quick turnaround times and offer a myriad of options including cash advances based on sales, profit share models, and other cashflow based financing models.